Meezan Bank Interest-Free Solar Panel Systems

Meezan Bank has started offering Sharia benefits to its customers. The Meezan Bank solar panel financing program 2023 guarantees access to renewable energy with payment plans and reasonable prices. The plant’s electricity bill is reduced by 50%. Also, you can install solar panels without interest as this system is Sharia-compliant.

The balance solar homeowners are perfect for generating your power source. The additional electricity generated by net metering is also sold to the national electricity industry, making the environment cleaner.

Your solar panel offers you a cheaper and more accessible way to invest in renewable energy and reduce your electricity bills. With Balance Bank, your simple payment projects are competitive. You have access to expert advice to help you with pricing and this process.

Eligibility Criteria

Employee (permanent position)

- Nationality: The applicant is a Pakistani, a permanent resident, and a holder of a national identity card.

- Applicant Age: The minimum age must be 20 and the maximum age must be 60 to apply for this program.

- Age of the co-applicant: Maximum 75 years.

- Employment Status: Must be permanent.

- Income: The minimum wage should be 1 lakh.

- Duration of employment: Have been in permanent employment for at least two years.

- Tax Beneficiary: The annual tax beneficiary must have an NTN number.

- References: At least two certificates are required.

- Meezan Bank Account: If the applicant’s balance is not currently a bank account, it will be opened for a financing offer.

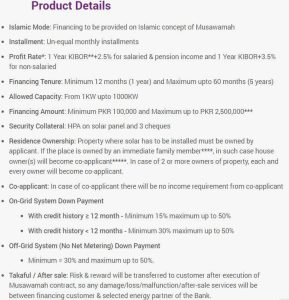

Product Details

The price of this solar panel, specifications, and all information about it are as follows:

Costs Involved

| Type of Charges | Chargers |

| Processing Charges | PKR 5,000 + FED |

| Documentation charges | At Actual |

| Late payment charges | Nil |

| Meezan Energy Partner survey charges | At Actual (if any) |

| Termination |

Can be terminated anytime by paying the remaining installments

|

| STR Fee | PKR 1,000 |

How To Register Online

- To apply, you must go to the nearest bank branch. All information can be obtained by calling the following telephone service i.e. 111-331-331/111-331-332

- Get a Solarjee offer as an affiliate at Mizan Bank

- Submit a copy of the signed CNIC application form along with a copy of the itemized utility bill

- You will receive a form that you can also get from the bank and download online.

- Once the form is filled out, you need to present it at the nearest bank branch.

Required Documents For Meezan Bank Interest-Free Solar Panel Systems

General Documents

- Property ownership proof

- Current electricity bill

- Completed application form

- Copy of the current CNIC ID Card

- Photos (1)

- Signature Verification Form

- Funding Statement

- A valid offer from Meezan Bank’s Authorized Solar Provider

Employee Candidates

- Last payslip

- Employment letter

- Justice Department evidence

- Proof of employment status

- Account statement for 6 months

- Audited financial statements and letters from the company if the candidate is a paid director

Self-employed Businessman Applicants

- Sole Proprietorship

A. NTN

B. Bank Title Deed

C. Tax returns

- Partnership

A. Company certificate (latest and previous if applicable)

B. Certificate from the Registrar of Companies if the company is registered.

C. 6-month bank statement (from the company or candidate partner)

- Limited Liability Companies

A. Memorandum of Articles

B. Association of Articles

C. Certificate of Incorporation

D. Latest Form-A

E. Latest Form-29

F. Audited Financials

G. 6 months bank statement (of the company or the applicant director).

Pensioner Applicants

- Copy of pension book/certificate (must be issued by the AGPR or the General Accounting Office of the Republic)

- 6-month bank statements reflecting the net pension credited to the account.

Also Read: Apni Bike Scheme – Bike On Installment Without Interest